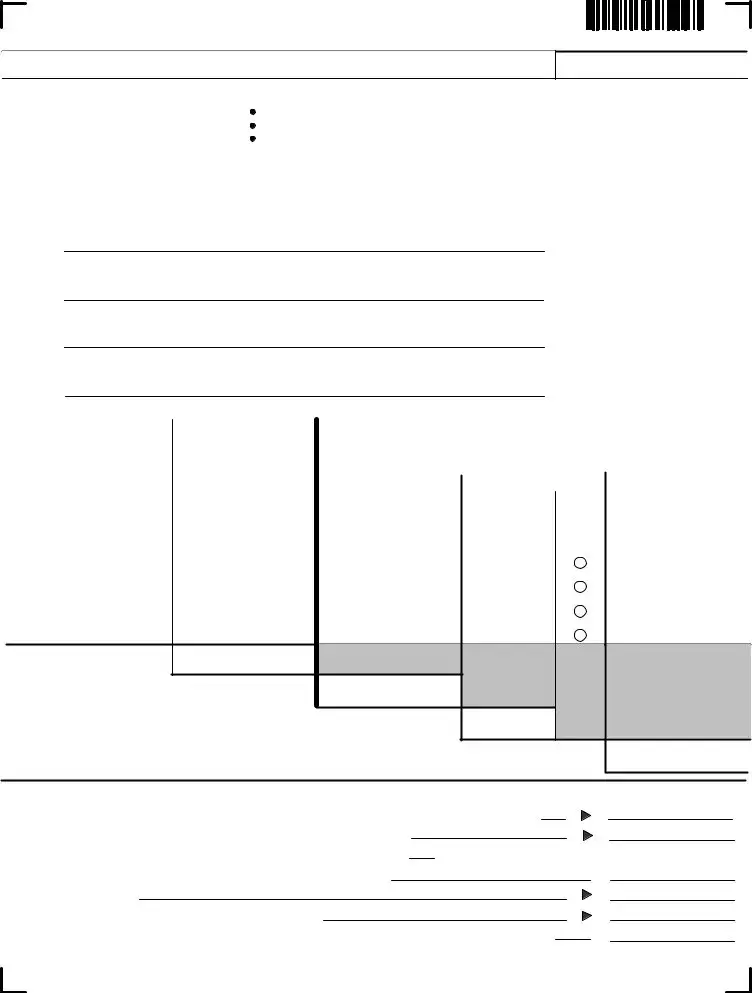

North Dakota 38 Template

The North Dakota 38 form is a fiduciary income tax return used by estates and trusts to report their taxable income and calculate their tax liability for the calendar year. This form is essential for fiduciaries to fulfill their tax obligations in North Dakota. To ensure compliance and avoid penalties, it is important to accurately complete the form.

Start your process by filling out the North Dakota 38 form today by clicking the button below.

Launch North Dakota 38 Editor Now

North Dakota 38 Template

Launch North Dakota 38 Editor Now

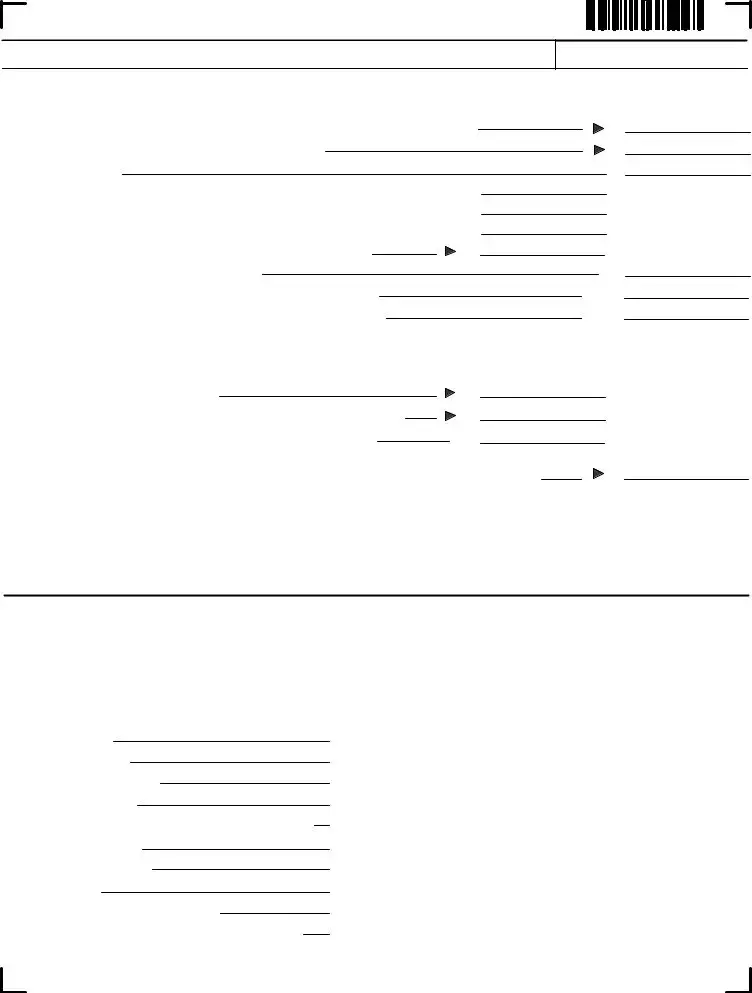

You’re halfway through — finish the form

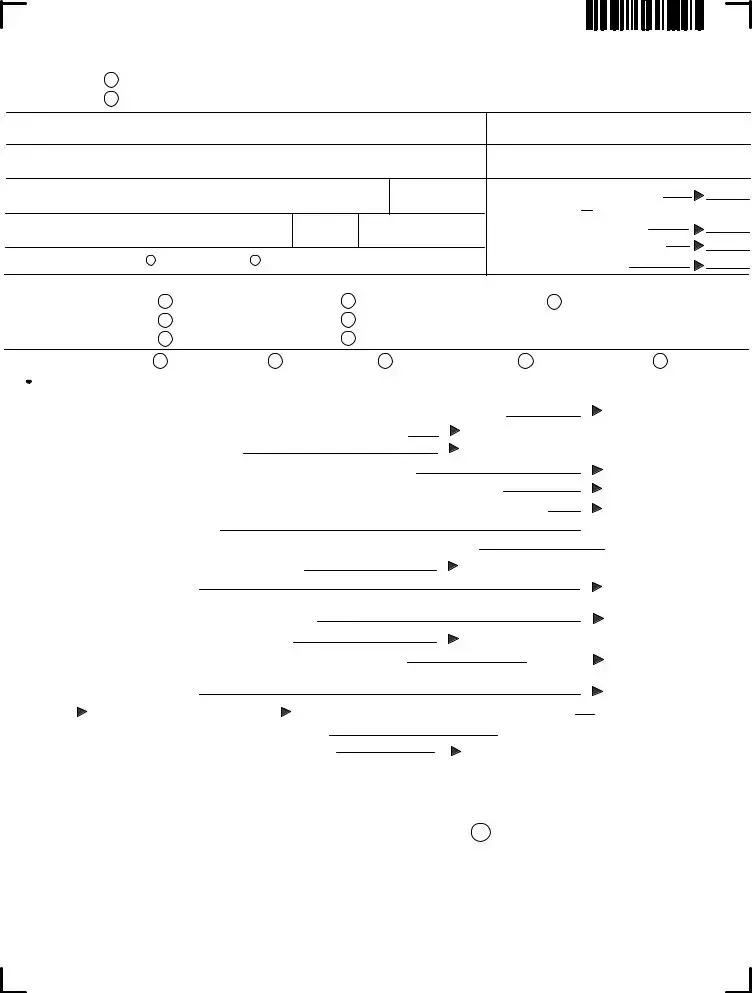

Edit and complete North Dakota 38 online in just a few steps.

Launch North Dakota 38 Editor Now

or

▼ PDF Form

5

5  6

6